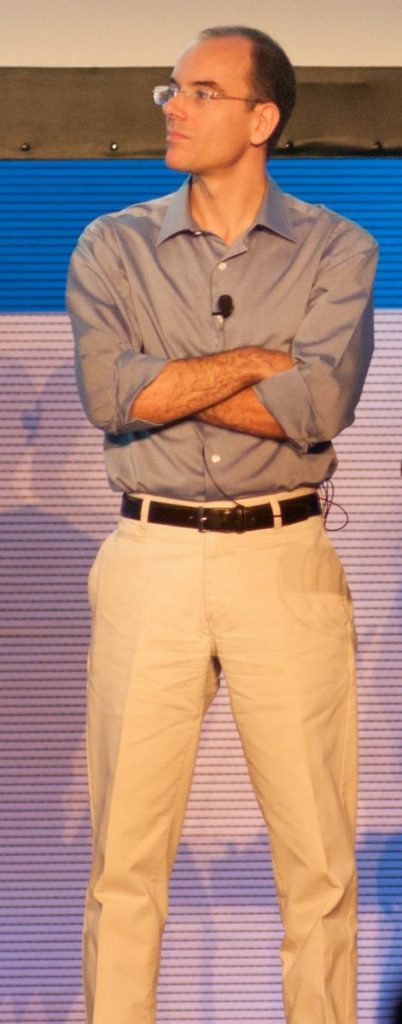

Luís Santos-Pinto is a Professor of Economics at HEC Lausanne, the Faculty of Business and Economics of the University of Lausanne. He holds a PhD in Economics from University of California, San Diego. Prior to joining the University of Lausanne in 2008, he worked at Nova School of Business & Economics from 2004 to 2008.

His main area of research is Behavioral Economics. He investigates the links between information, cognition, judgment, and economic behavior. He studies the implications of behavioral biases like overconfidence and optimism in terms of individual decision making, the design of incentives in organizations, market outcomes, and welfare. He uses laboratory and field experiments to study the existence and consequences of these biases for economic decisions.

His research spans over the areas of Behavioral, Experimental, and Labor Economics. His work is published in American Economic Review, Journal of Labor Economics, The Economic Journal, European Economic Review, Experimental Economics, International Economic Review, Journal of Risk and Uncertainty, The Scandinavian Journal of Economics, Journal of Economic Behavior & Organization, Review of Economic Design, Journal of Mathematical Economics, Economics Letters, International Journal of Game Theory, International Journal of Industrial Organization, Theory and Decision, and Games.

He teaches courses at the BA, MA, Executive MBA, and PhD levels. He teaches a variety of courses including Behavioral Economics, Game Theory, Industrial Organization, and The Economics of Asymmetric Information.

WORKING PAPERS

Beyond the Stars: Exploring the Welfare Effects of Ratings in Differentiated Markets, with Noah Bohren and Rustamdjan Hakimov.

Subjective Evaluation Contracts for Overconfident Workers, with Matteo Foschi. R&R RAND Journal of Economics Main Appendix Online Appendix

Learning and Overconfidence in Elimination Contests, with Petros Sekeris.

PUBLICATIONS

Overconfidence in Tullock Contests, with Petros Sekeris. Forthcoming Public Choice

Less Risk, More Effort: How Overconfidence Reshapes Tournament Strategies, with Noëmi Jacober. Online Appendix Forthcoming Mathematical Social Sciences

How Economic Exchange Can Favour Human Genetic Diversity, with Cédric Perret and Laurent Lehmann. Forthcoming Proceedings of the Royal Society B: Biological Sciences

Overconfidence and Strategic Behavior in Elimination Contests: Implications for CEO Selection, with Yuxi Chen. Forthcoming Review of Economic Design Online Appendix

How Confidence Heterogeneity Shapes Effort and Performance in Tournaments and Contests, with Petros Sekeris. Journal of Mathematical Economics, 2025, Vol. 116, 103069.

The Role of Self-Confidence in Teamwork: Experimental Evidence, with Adrian Bruhin and Fidel Petros.

Experimental Economics, 2024, Vol. 27, Issue 3, 687-712. Appendix

Experimental Evidence on the Transmission of Honesty and Dishonesty: A Stairway to Heaven and a Highway to Hell, with Georgia Michailidou and Paola Colzani.

Economics Letters, 2023, Vol. 231, 111257. Appendix

Can Optimism Solve the Entrepreneurial Earnings Puzzle?, with Michele Dell’Era and Luca David Opromolla.

The Scandinavian Journal of Economics, 2023, Vol. 125, No. 1, 139-169. Appendix

Risk and Rationality: The Relative Importance of Probability Weighting and Choice Set Dependence, with Adrian Bruhin and Maha Manai.

Journal of Risk and Uncertainty, 2022, Vol. 65, No. 2, 139-184. Appendix

Human Capital Accumulation and the Evolution of Overconfidence

Games, 2020, 11.

Overconfidence and Timing of Entry, with Tiago Pires.

Games, 2020, 11.

Overconfidence in Labor Markets, with Leonidas Enrique de la Rosa.

Handbook of Labor, Human Resources and Population and Economics, 2020, ed. Klaus Zimmermann, Springer.

How Do Beliefs about Skill Affect Risky Decisions?, with Adrian Bruhin and David Staubli.

Journal of Economic Behavior & Organization, 2018, Vol. 150, 350-371.

Entrepreneurial Optimism and the Market for New Issues, with Michele Dell’Era.

International Economic Review, 2017, Vol. 58, No. 2, 383-419.

Home Bias in Multimarket Cournot Games, with Catherine Roux and Christian Thöni.

European Economic Review, 2016, Vol. 89, 361-371.

Detecting Heterogeneous Risk Attitudes with Mixed Gambles, with Adrian Bruhin, José Mata, and Thomas Astebro.

Theory and Decision, 2015, Vol. 79, Issue 4, 573-600.

Skewness Seeking: Risk Loving, Optimism or Overweighting of Small Probabilities?, with Thomas Astebro and José Mata.

Theory and Decision, 2015, Vol. 78, Issue 2, 189-208. Appendix

A Cognitive Hierarchy Model of Behavior in the Action Commitment Game, with Daniel Carvalho.

International Journal of Game Theory, 2014, Vol. 43, Issue 3, 551-577.

Experimental Cournot Oligopoly and Inequity Aversion, with Doruk Iris.

Theory and Decision, 2014, Vol. 76, Issue 1, 31-45.

Tacit Collusion under Fairness and Reciprocity, with Doruk Iris.

Games, 2013, 4, 50-65.

Labor Market Signaling and Self-Confidence: Wage Compression and the Gender Pay Gap

Journal of Labor Economics, 2012, Vol. 30, No. 4, 873-914.

Positive Self-Image in Tournaments

International Economic Review, 2010, Vol. 51, No. 2, 475-496.

Overconfidence in Tournaments: Evidence from the Field, with Young-Joon Park.

Theory and Decision, 2010, Vol. 69, 143-166.

The Impact of Firm Cost and Market Size Asymmetries on National Mergers in a Three-Country Model

International Journal of Industrial Organization, 2010, Vol. 28, 682-694.

Asymmetries in Information Processing in a Decision Theory Framework

Theory and Decision, 2009, Vol. 66, 317-343.

Positive Self-Image and Incentives in Organizations

The Economic Journal, 2008, Vol. 118, 1315-1332.

Making Sense of the Experimental Evidence on Endogenous Timing in Duopoly Markets

Journal of Economic Behavior & Organization, 2008, Vol. 68, 657-666.

A Model of Positive Self-Image in Subjective Assessments, with Joel Sobel.

American Economic Review, 2005, Vol. 95, No. 5, 1386-1402.

“Nothing is so difficult as not deceiving oneself.”

Ludwig Wittgenstein

“No rational argument will have a rational effect on a man who does not adopt a rational attitude.”

Karl Popper

“A model is a lie that helps you see the truth.”

Howard Skipper

“Men follow their sentiments and their self-interest, but it pleases them to imagine that they follow reason. And so they look for, and always find, some theory which, a posteriori, makes their actions appear to be logical. If that theory could be demolished scientifically, the only result would be that another theory would be substituted for the first one, and for the same purpose.”

Vilfred Pareto

“Thus, just as animals of many species, including man, are disposed to respond with fear to sudden movement or a marked change in level of sound or light because to do so has a survival value, so are many species, including man, disposed to respond to separation from a potentially caregiving figure and for the same reasons.”

John Bowlby

“People do not ever fully overcome the egocentrism that Piaget and others claim to be characteristic of the immature social perceiver.”

Griffin, Dunning, and Ross

“If… deceit is fundamental to animal communication, then there must be strong selection to spot deception and this ought, in turn, to select for a degree of self-deception, rendering some facts and motives unconscious so as not to betray — by the subtle signs of self-knowledge — the deception being practiced.’ Thus, ‘the conventional view that natural selection favors nervous systems which produce ever more accurate images of the world must be a very naive view of mental evolution.”

Robert Trivers